Global Scans

·

Uber

·

Organization Briefing

1. Key Trends

- Autonomous Vehicle Integration: Uber is aggressively advancing its autonomous vehicle (AV) strategy, positioning it as a core growth driver. Launching Uber Autonomous solutions aims to boost both revenue and margin expansion.

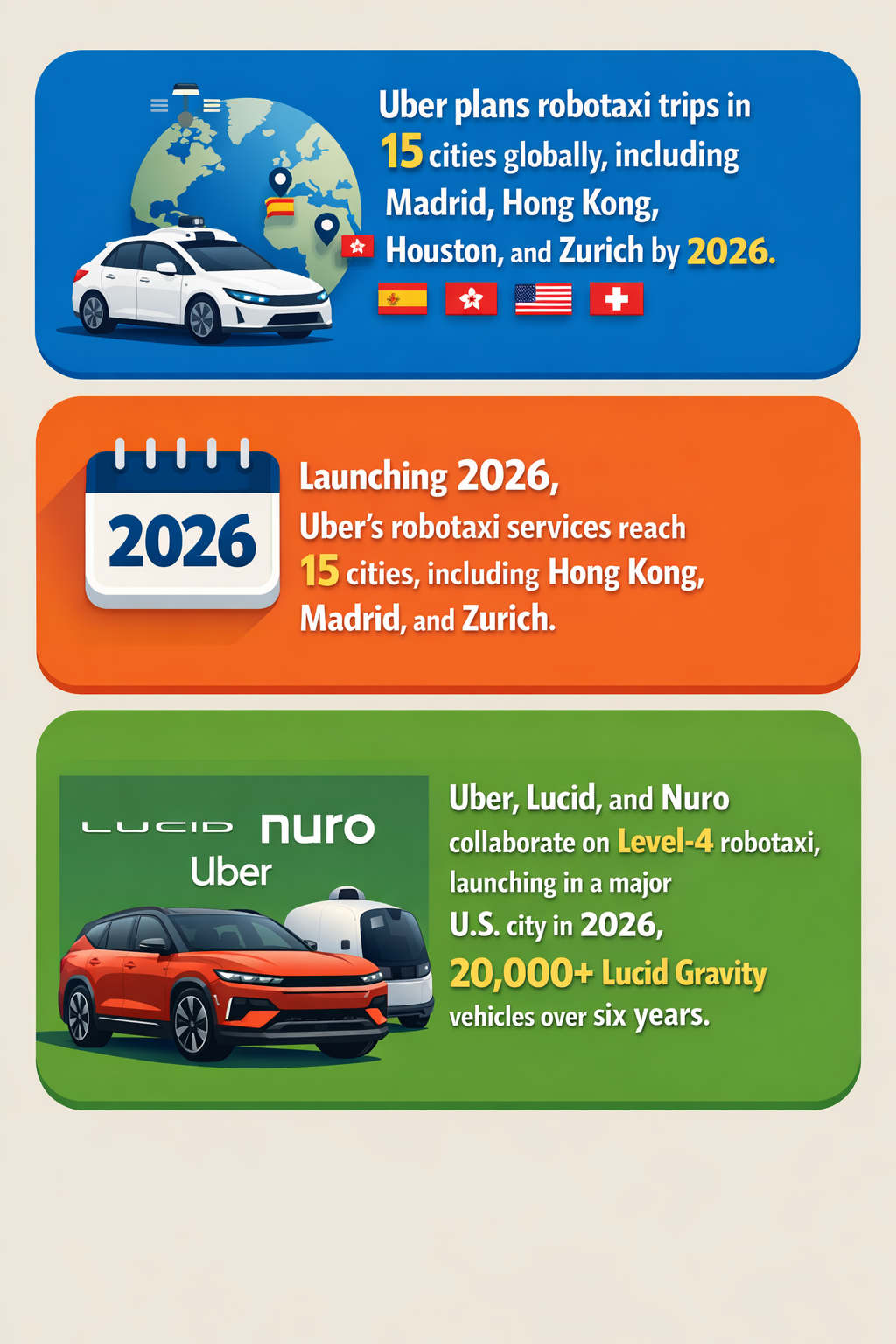

- Geographic Expansion of Robotaxis: Uber plans to deploy driverless taxis in Madrid by 2026, marking a major step in European market penetration for AV services.

- Platform Ecosystem Enhancement: Uber is consolidating tools to facilitate onboarding of robotaxi developers and vehicle owners, expanding its platform from a simple ride-hailing app into an integrated AV ecosystem.

- Technology Partnerships: Collaborations with AI-driven platforms like Wayve indicate Uber’s reliance on external tech innovation to accelerate international robotaxi rollouts.

- Competitive Pressure from OEMs: Tesla’s intent to target ride-hailing with its Cybercab introduces a new alternative model combining private ownership and platform-based ride-hailing competition.

2. Competitive Moves

- Product Launches: Planned Uber Autonomous launch with robotaxi deployments in Los Angeles (2026) and Madrid (2026) represent pioneering AV service rollouts.

- Pricing & Service Model: While explicit pricing strategies are not detailed, autonomous taxi deployment is expected to impact ride costs and service availability, potentially lowering operational costs.

- Partnerships: Uber’s engagement with Wayve, backed by substantial $1.2 billion funding, strengthens its AI driving capabilities, highlighting strategic collaboration for tech edge.

- Technology Adoption: Uber continues to build a comprehensive developer and vehicle-owner toolkit for robotaxis, facilitating faster integration and scaling of AVs on its platform.

3. Market Impact

- Industry Dynamics: Uber’s AV rollout is poised to disrupt traditional ride-hailing economics by reducing driver dependency, impacting competitor business models and labor markets.

- Customer Expectations: Increased availability of autonomous taxis may shift customer priorities towards safety, convenience, and cost efficiency, raising industry service standards.

- Regulatory Landscapes: Operations in Madrid and Los Angeles highlight differing municipal regulatory stances toward driverless vehicles, signaling potential challenges and precedents for further AV adoption globally.

- Competitive Benchmarking: Tesla’s Cybercab initiative introduces a hybrid model challenging Uber’s purely platform-based deployment, potentially fragmenting the ride-hailing market.

4. Risks & Opportunities

- Risks:

- Regulatory hurdles in cities delaying AV rollouts could slow expansion and erode first-mover advantages.

- Emergence of OEM competitors like Tesla may erode market share and reduce Uber’s pricing power.

- Technology failure or safety incidents involving autonomous vehicles could damage brand trust and invite regulatory backlash.

- Opportunities:

- Strategic scans of evolving AV ecosystems could enable early identification of promising tech partners beyond Wayve.

- Scenario planning around regulatory shifts can prepare adaptive market entry or withdrawal strategies.

- Enhanced platform capabilities for AV integration can position Uber as a key facilitator in future mobility ecosystems.

5. Recommended Monitoring Strategies

- Key Data Sources: Track press releases and news updates from Uber, Wayve, and Tesla; regulatory updates in key urban markets like Madrid and Los Angeles; technology benchmarking reports on autonomous driving AI.

- Frequency of Updates: Monthly scans to capture fast-moving tech developments; quarterly deep-dives on regulatory and market impacts; event-driven alerts when Uber announces new pilot programs or partnerships.

- Methodologies: Horizon scanning using AI-powered news aggregators; scenario workshops to assess regulatory and competitive disruptions; real-time social media sentiment analysis around Uber’s AV deployments.

- Benchmark Metrics: Number of autonomous vehicles deployed; coverage regions/cities; funding rounds and tech partner expansions; safety incident reports and regulatory approvals.

- Expert Engagement: Regular consultations with AV technology experts, city transportation planners, and mobility analysts to validate intelligence and refine strategic assumptions.

Monitoring these dimensions will enable proactive adaptation and strategic differentiation aligned with Uber’s commitment to autonomous mobility growth.

Briefing Created: 02/03/2026