Emerging Water Stress as a Critical Disruptor of Global Industry and Security

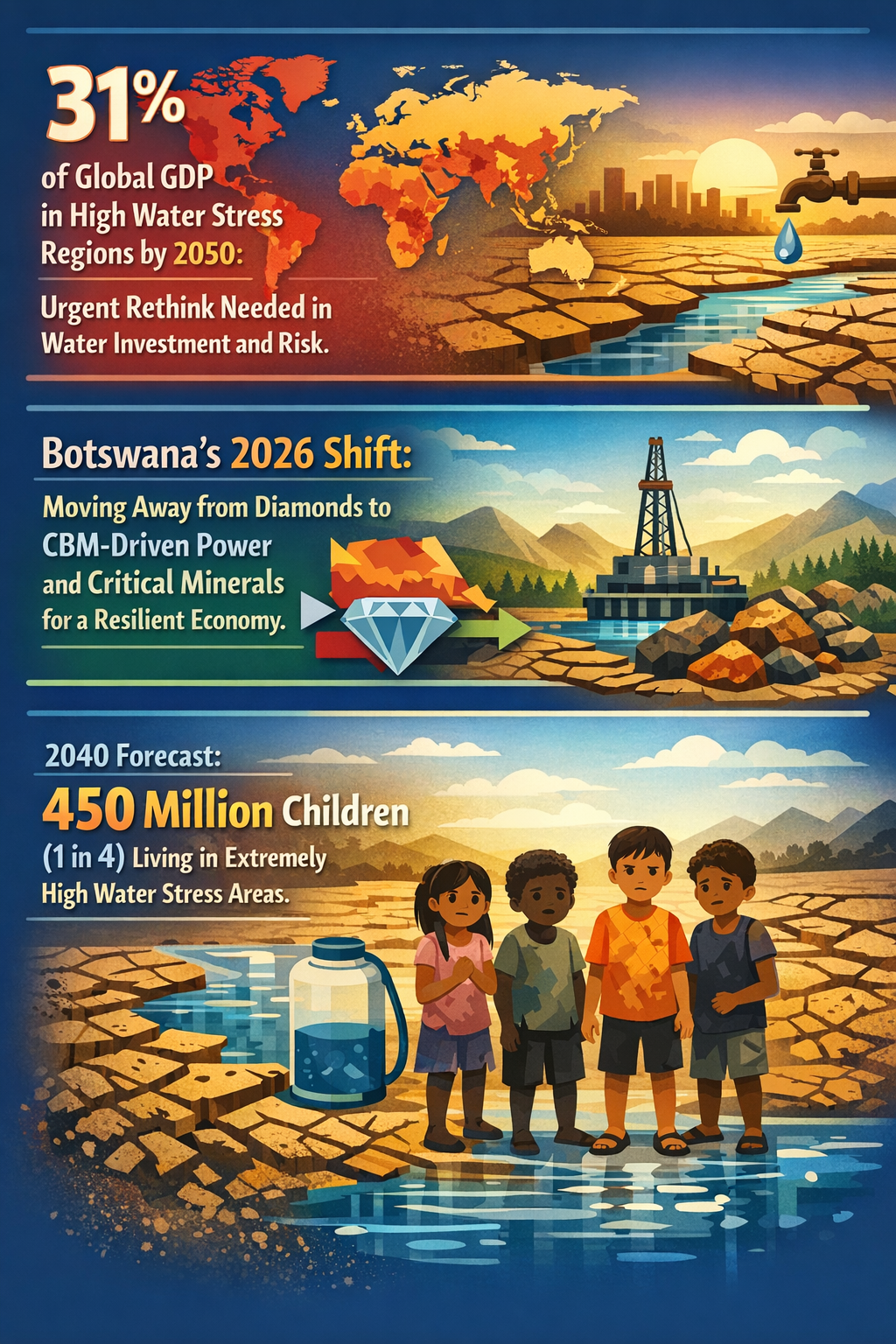

Water scarcity is an escalating risk that transcends traditional environmental concerns to emerge as a potent disruptor of global economies, industries, and geopolitical landscapes. By 2050, as much as 31% of global GDP could be exposed to critical water stress, forcing business, government, and civil society to rethink water not just as a resource but as a systemic risk factor. Increasingly, water scarcity intersects with sectors such as mining, agriculture, and infrastructure, threatening supply chains, critical resource access, and strategic security. This article surfaces a key weak signal: the intertwining of water stress with critical mineral extraction and infrastructure resilience, which may reframe the future competitive dynamics of economies.

What’s Changing?

Water scarcity figures prominently as a future challenge in multiple sectors and regions. The World Resources Institute classifies countries like Mexico as facing “extremely high baseline water stress,” highlighting a geographic spread of vulnerability where water demand could soon exceed supply without major changes in management (Source).

Mining operations exemplify crucial intersections of water and strategic resource security. Approximately 75% of global mining activities are located in water-stressed areas, creating an existential threat to extraction continuity and increased operational risks (Source). This situation gains complexity as mining shifts towards securing critical minerals—elements essential to technology, energy transitions, and national security priorities. The United States and allies have explicitly expressed intent to prevent adversaries, such as China, from controlling critical mineral supply chains, further intensifying demand pressure (Source).

A novel development is the emergent policy discussion on guaranteeing minimum prices for critical minerals and rare earths by governments in the US, UK, EU, and Australia, indicating increased state intervention to stabilize and secure supply chains amid geopolitical tensions (Source).

Agriculture, responsible for the largest share of global freshwater use, is also evolving toward more data-driven, modular, and remotely managed irrigation systems. These innovations aim to create farming landscapes that are both resilient to water scarcity and sustainable (Source). However, agricultural water stress itself is upstream of other critical sectors, potentially disrupting food supplies, labor markets, and overall economic stability.

Botswana’s 2026 economic pivot away from diamond dependence towards critical minerals and coal bed methane (CBM) power exports represents a regional-level example of adapting to intertwined resource and water scarcity pressures. This structural shift may inspire other resource-dependent economies to diversify in ways closely tied to water availability and strategic commodity demands (Source).

Finally, intense water stress is expected to place nearly a third of global GDP at risk by 2050, underscoring the urgency to rethink water governance, investment, and risk frameworks on a systemic level (Source, Source).

Why Is This Important?

Water scarcity is not only an environmental or operational risk; it increasingly represents a strategic vulnerability tied to economic output and national security priorities. Industries reliant on water-intensive processes—mining, agriculture, energy—may face interruptions, escalating costs, and regulatory restrictions.

For mining, water scarcity might constrain extraction of essential minerals needed for technology and renewable energy sectors, complicating supply chains already under geopolitical pressure. Governments may be compelled to intervene economically and politically, affecting the global balance of power in resource control.

In agriculture, failure to adopt efficient water management technologies could restrict food production and destabilize rural economies, exacerbating economic inequalities and migration pressures. Innovations such as modular and remotely managed irrigation systems could, if scaled effectively, reduce water waste and improve resilience but may require significant initial investment and policy support.

Regions with acute water stress, such as parts of Mexico and Southern Africa, face compounded risks of economic disruption and social instability, potentially triggering rapid shifts in trade, investment, and geopolitical alliances. Botswana’s pivot away from diamonds toward a diversified resource base dependent on water availability is a case in point.

Overall, water scarcity’s impact on 31% of global GDP might trigger cascading effects across supply chains, price volatility, and investment patterns. These disruptions may come suddenly as water risk thresholds are crossed, rather than gradually, representing a weak but high-impact signal.

Implications

This emerging intertwining of water scarcity with critical mineral supply chains and key economic sectors suggests several areas for strategic foresight and action:

- Risk-integrated water management: Organizations across industries should incorporate water stress analysis into supply chain risk frameworks, particularly emphasizing critical mineral sourcing and agricultural inputs.

- Scenario-based strategic planning: Governments and businesses must develop scenarios that factor acute water scarcity not only as an environmental issue but as a systemic economic and geopolitical disruptor.

- Investment in water-efficient technologies: Accelerating adoption of precision irrigation, recycling, and water reclamation technologies in agriculture and mining operations could improve resilience.

- Policy and cooperation frameworks: Cross-border water governance and international cooperation may become essential to managing shared water resources and avoiding conflict related to critical minerals and infrastructure.

- Economic diversification strategies: Resource-dependent economies might consider diversifying both their economic base and water consumption patterns, similar to Botswana’s recent pivot.

- Market instruments and price stabilization: The discussion around guaranteed minimum prices for critical minerals signals potential for more active controls in commodity markets linked with water and resource risks.

These implications demonstrate a necessity for integrated approaches across sectors and scales. Water scarcity could catalyze transformative disruption across industries if left unaddressed or underestimated.

Questions

- How might water scarcity reshape global supply chains for critical minerals and technologies over the next two decades?

- What investments in water-efficient technologies or infrastructure could yield the strongest resilience returns for key sectors like mining and agriculture?

- Which governments or regions are most exposed to compounded risk from water scarcity and critical resource dependencies?

- How can public-private partnerships innovate governance frameworks to manage shared water and mineral resources sustainably?

- What market mechanisms—such as price guarantees or water rights trading—could emerge to stabilize systems vulnerable to water and resource shocks?

- How might demographic and migration patterns evolve in response to regional water stress linked to economic disruption?

Keywords

water scarcity; critical minerals; water-stressed regions; mining operations; agricultural irrigation; geopolitical risk; supply chain risk; resource diversification

Bibliography

- 2026 Kicks Off to the Sound of Imperialist War Drums and Class Struggle. Marxist.com. https://marxist.com/2026-kicks-off-to-the-sound-of-imperialist-war-drums-and-class-struggle.htm

- By 2050, up to a third of global GDP could be exposed to high water stress if current trajectories persist. Water Diplomat. https://www.waterdiplomat.org/story/2026/02/financing-water-foundational-climate-infrastructure-turning-vision-action-2026-un

- Mexico’s Water Crisis Becomes an Economic Threat. Dean Barber Substack. https://deanbarber.substack.com/p/mexicos-water-crisis-becomes-an-economic

- Overhead Netafim Irrigation System 2026 Trends. Farmonaut. https://farmonaut.com/precision-farming/overhead-netafim-irrigation-system-2026-trends

- Mining Sustainability Transformation 2026 Strategic Scenarios. DiscoveryAlert Australia. https://discoveryalert.com.au/mining-sustainability-transformation-2026-strategic-scenarios/

- The Year of Water. Interactive Brokers. https://www.interactivebrokers.com/campus/traders-insight/securities/futures/the-year-of-water/

- Sustainable Finance Roundup January 2026: Geopolitics, Energy Transitions, and Systemic Risk. Altiorem. https://altiorem.org/2026/02/02/sustainable-finance-roundup-january-2026-geopolitics-energy-transitions-and-systemic-risk/

- Botswana Bets on CBM, Critical Minerals in 2026. Energy Capital Power. https://energycapitalpower.com/botswana-bets-on-cbm-critical-minerals-in-2026/

- US, UK, EU, Australia Discuss Guaranteed Minimum Prices for Critical Minerals. The Guardian. https://www.theguardian.com/business/2026/feb/01/us-uk-eu-australia-critical-minerals-rare-earths-g7-minimum-price

- At Davos 2026, Sustainability Was Everywhere — Just Not in the Headlines. Investing News. https://investingnews.com/at-davos-2026-sustainability-was-everywhere-just-not-in-the-headlines/