Global Scans · Connectivity · Signal Scanner

Satellite-Enabled Private 5G Networks: A Weak Signal Poised to Transform Industrial Connectivity

Emerging developments in satellite-based internet combined with private 5G network deployments represent a weak signal with the potential to disrupt the future of industrial connectivity. These hybrid networks could extend ultra-reliable, low-latency communications beyond traditional ground infrastructure, reshaping industries ranging from manufacturing and logistics to aviation and energy. This article explores recent moves in satellite-enabled networks, private 5G expansion, and industrial IoT growth to outline a future connectivity ecosystem few strategists are fully prepared to address.

What's Changing?

The pace of satellite network expansion is accelerating significantly. SpaceX alone projects Starlink revenue reaching between $22 billion and $24 billion by 2026, driven by additive satellite capacity and increased customer adoption (The Verge). Parallel ventures, such as Amazon’s Kuiper project, plan to establish space-based internet coverage that stretches far beyond the scope of current terrestrial networks, effectively dissolving geographic connectivity constraints (Aipix.ai).

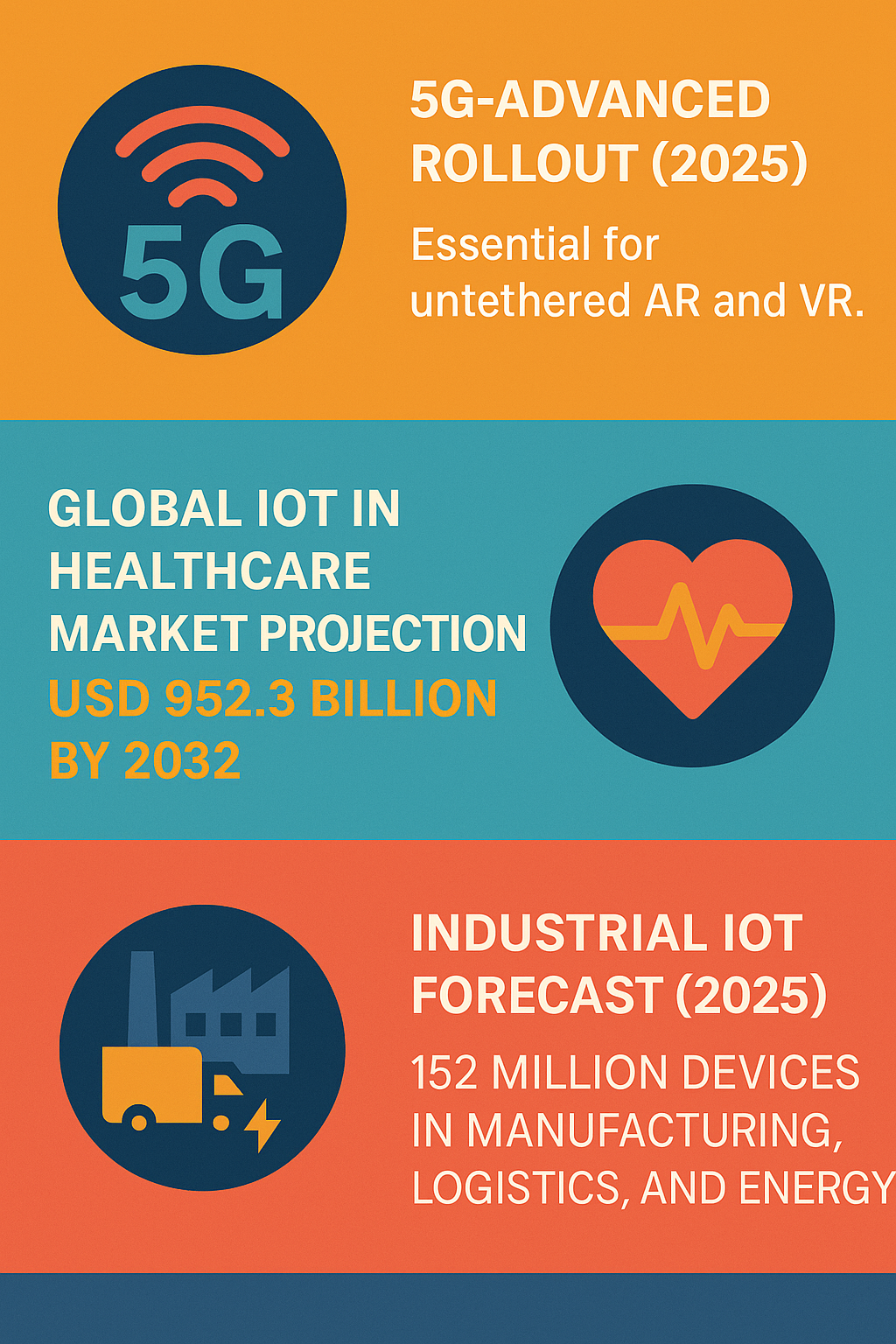

Simultaneously, private 4G and 5G networks are forecast to experience explosive growth, with global spending projected to exceed $7.2 billion by 2028 (The Silicon Review). These networks, tailored for industrial IoT applications, bypass public network constraints, offering enhanced security, control, and reliability crucial for sectors such as manufacturing automation, logistics tracking, and energy infrastructure monitoring (Quantumrun; DynamicSourceMFG).

A critical technical development supporting this trajectory is the imminent introduction of 5G eRedCap modules, expected from 2026 onward. These modules promise optimized connectivity for a broader range of IoT devices, enabling cost-effective, power-efficient endpoints with industrial-grade reliability (TelecomLead).

Perhaps the most visible early adopter demonstrating the blend of satellite and private network technology is British Airways’ partnership with Starlink. From 2026, over 500 aircraft will be outfitted with Starlink’s satellite Wi-Fi to provide fast, reliable inflight internet—a commercial aviation first that merges terrestrial cellular and satellite capabilities (MeOnTravel).

Such efforts signal a shift from satellite internet as an isolated consumer alternative to a complementary backbone capable of integrating with localized private 5G networks. This architectural evolution may address well-known 5G limitations related to remote coverage gaps, signal penetration, and infrastructure costs, particularly for industrial IoT deployments in dispersed or hard-to-wire environments.

Underlying these connectivity advances is a larger IoT transformation. Industrial IoT devices are projected to surpass 152 million by 2025, across sectors automating manufacturing lines, monitoring energy grids, and managing vast logistics chains (Quantumrun). By 2035, IoT might evolve from an enabling technology into the foundational infrastructure layer of digital enterprises, relying heavily on ubiquitous, hybrid connectivity (Ian Khan).

Why is this Important?

The fusion of satellite internet and private 5G networks could substantially alter the strategic calculus for industrial and commercial connectivity. Historically, the high cost and complexity of private network construction, along with geographic and infrastructural constraints, limited deployment scope. Satellite integration offers a redundancy and reach mechanism that can make private 5G access more feasible, flexible, and resilient.

For enterprises, this means the possibility of:

- Deploying reliable, ultra-low-latency networks in previously unreachable or cost-prohibitive locations.

- Maintaining critical connectivity during terrestrial network outages owing to weather, disasters, or geopolitical disruptions.

- Scaling IoT ecosystems dynamically as satellite capacity typically scales faster than ground-based alternatives.

For industries such as manufacturing and logistics, this hybrid network approach could facilitate more precise real-time monitoring and automated control of assets distributed across expansive areas. Energy and utilities might leverage such networks to support smart grid operations and predictive maintenance with improved reliability and security.

The aviation sector is an early exemplar of satellite-5G synergy, where inflight connectivity improves passenger experience while also laying the groundwork for enhanced operational communications, safety monitoring, and data analytics. This model might extend to maritime, remote mining, agriculture, and even governmental emergency response frameworks.

These connectivity shifts could redefine competitive advantages and risk profiles:

- New entrants might challenge incumbent telecommunications operators by leveraging satellite-enabled private networks.

- Regulators will face pressure to harmonize spectrum allocations and interoperability standards to support seamless hybrid network operation.

- Supply chains and security considerations evolve as networks become more complex and interconnected across terrestrial-satellite domains.

Implications

Industry leaders, government planners, and researchers should monitor and prepare for satellite-enabled private 5G as a potential disruptor that could upend conventional connectivity paradigms. Key implications include:

- Strategic network design: Organizations could need to rethink connectivity architectures to integrate satellite links into private 5G deployments. This may require cross-sector collaborations between satellite operators, 5G vendors, and industrial end-users.

- Investment shifts: Capital allocation may increasingly favor hybrid infrastructure investments that balance terrestrial 5G investments with satellite capacity subscriptions or partnerships.

- Security frameworks: Complex hybrid environments introduce novel cybersecurity challenges, necessitating new standards for encryption, access control, and anomaly detection across satellite and terrestrial components.

- Policy and regulation: Policymakers might accelerate efforts to define spectrum sharing, licensing, and data sovereignty rules to accommodate integrated network models that transcend national borders.

- Supply chain resilience: Hybrid networks can create more robust communication backbones that reduce single points of failure, increasing operational continuity in crises.

- Technology development: The rise of 5G eRedCap and other specialized IoT modules tailored for industrial use could accelerate adoption and innovation in connected devices optimized for satellite-enhanced networks.

To harness these implications, organizations may want to pilot satellite integration in isolated 5G environments, evaluate vendor partnerships emerging in this space, and develop internal capabilities to assess hybrid network performance and risks.

Questions

- How could integrating satellite connectivity within private 5G networks reshape your organization’s industrial IoT strategy?

- What operational or security risks might arise from deploying hybrid satellite-terrestrial networks, and how can they be mitigated?

- Are current connectivity vendors in your ecosystem prepared to offer or support hybrid satellite-5G solutions?

- Which industry sectors or use cases within your scope might most benefit from ubiquitous connectivity beyond terrestrial reach?

- How might policy and regulatory environments evolve to either enable or constrain satellite-enabled private networks?

- What investment shifts are required to incorporate satellite capacity as part of digital infrastructure modernization plans?

Keywords

satellite networks; private 5G networks; industrial IoT; Starlink; 5G eRedCap; connectivity; digital transformation

Bibliography

- SpaceX expects $15 billion in 2025 revenue, and $22 billion to $24 billion in 2026, mostly due to Starlink. The Verge

- SNS Telecom forecasts global spending on private 4G & 5G networks will exceed $7.2 billion by 2028, driven by industrial IoT and enterprise digital transformation. The Silicon Review

- Enterprises will soon gain access to an expanding mix of connectivity technologies suited for diverse IoT requirements, adding that the introduction of 5G eRedCap modules from 2026 will drive strong connection growth through the next decade. TelecomLead

- Markets for industrial IoT and IoT in manufacturing are forecast to grow at double-digit CAGR through the next decade, reflecting the rapid deployment of connected sensors, edge devices, and intelligent control systems. DynamicSourceMFG

- British Airways has partnered with Starlink to bring fast, reliable satellite Wi-Fi to over 500 aircraft from 2026. MeOnTravel

- The expansion of space-based networks through Starlink, Amazon Kuiper and future satellite services will establish coverage that extends past traditional ground-based boundaries. Aipix.ai

- Itransition forecasts 152 million industrial IoT devices by 2025, driven by manufacturing automation, logistics tracking, and energy infrastructure monitoring applications. Quantumrun

- Over the next decade, IoT will transition from being a technology initiative to becoming the foundational layer of digital business. Ian Khan