Climate-Driven Migration as a Disruptive Trend Across Industries and Governments

Climate change is fostering a less visible but increasingly influential phenomenon: climate-driven migration triggered by progressive environmental degradation, such as sea-level rise, extreme heatwaves, and agricultural threats. This weak signal signals disruptive change that extends well beyond traditional environmental or humanitarian concerns, with ramifications across urban planning, real estate, insurance, labor markets, and geopolitical stability. As climate impacts accelerate, moving populations—both internally and transnationally—may become a defining driver shaping economic and governance systems in the next two decades.

What’s Changing?

Recent reporting underscores how climate impacts are already precipitating migration flows in diverse contexts, pointing toward a intensification of this phenomenon over the next 5 to 20 years.

Sea-level rise continues to threaten coastal and low-lying urban areas globally, not confined by political boundaries, as seen with cities in the Global North like Germany facing increased risks (Bosch Stiftung, 2026). Parallel trends are evident in the United States, where Miami’s chronic sea-level rise is forcing residents inland toward cities like Jacksonville and Atlanta (St. Augustine University, 2026). This internal climate migration is reshaping urban demographics and infrastructure demands, creating potentially unanticipated challenges for host cities.

Extreme heatwaves are compounding these pressures, notably across the Asia-Pacific, where rapid urbanization collides with social and economic vulnerabilities to magnify risk (United Nations, 2026). Health threats induced by rising temperatures further multiply the push factors driving movement, with implications for workforce productivity and public health systems worldwide (World Meteorological Organization, 2026).

Moreover, the intensification of systemic climate risks threatens financial stability through increased exposure of property and asset markets, as illustrated by pioneering European insurers integrating environmental, social, and governance (ESG) data into underwriting processes (Emerline, 2026). This development may presage a wider mainstreaming of climate risk in financial services globally, affecting credit availability and investment decisions tied to geographic climate vulnerability.

Significantly, the forced displacement associated with climate risks is no longer a distant or isolated worry. International human rights frameworks are pressing governments to anticipate and protect citizens facing predictable climate hazards, including planned relocations in vulnerable nations like the Philippines (Human Rights Watch, 2026). Efforts such as Malawi’s Climate Risk and Early Warning Systems (CREWS) initiative exemplify attempts to strengthen resilience through cross-sectoral collaboration (CODATA, 2026).

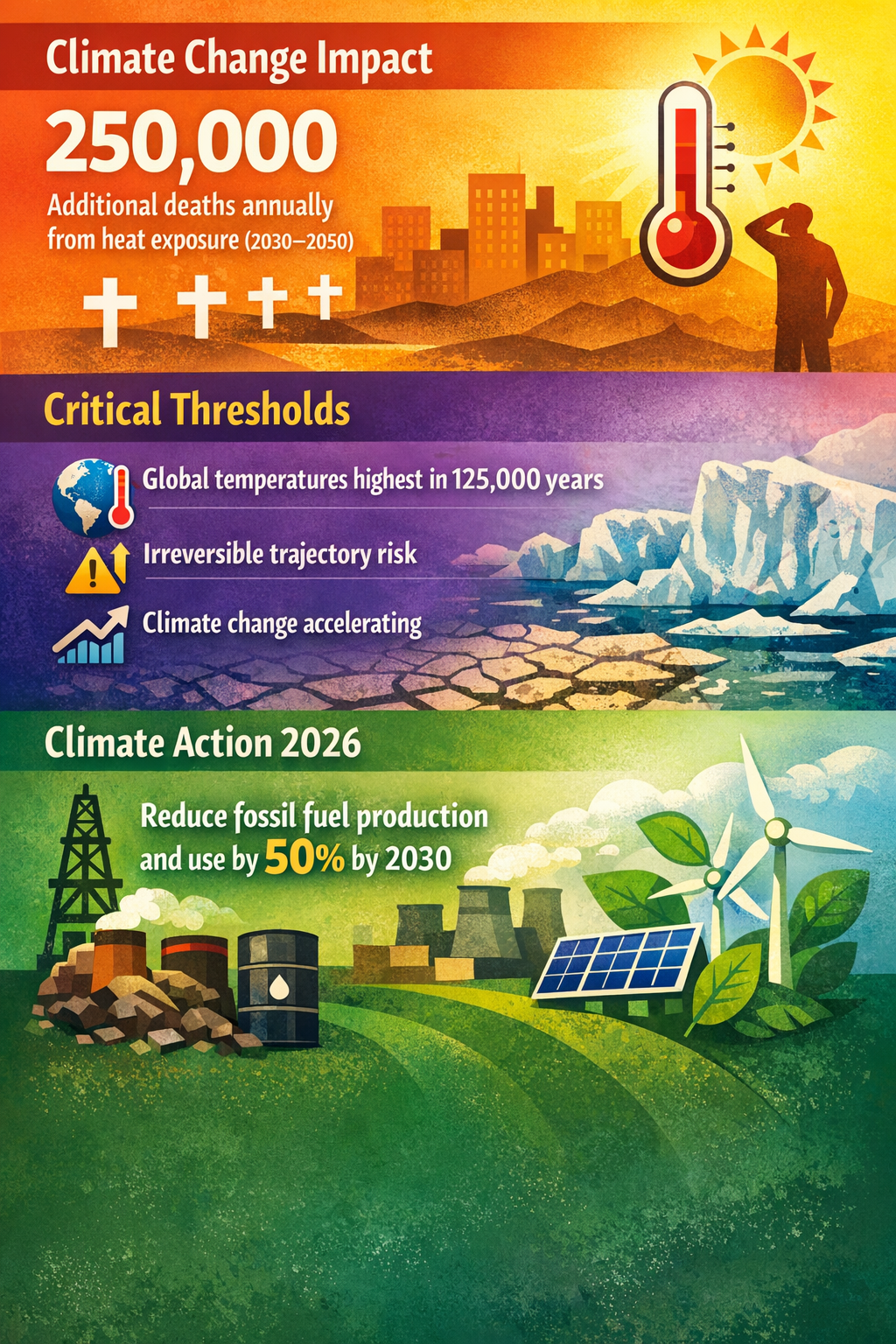

Underlying these distinct but interconnected developments is the specter of tipping points in Earth’s climate system, such as irreversible ice-sheet collapse or “hothouse Earth” trajectories, which could accelerate and lock in migration pressures far earlier than previously assumed (Coyote Gulch Blog, 2026; Anews, 2026). This scenario challenges conventional assumptions about the temporality and manageability of climate migration.

Why is This Important?

Climate-driven migration, while lightly examined relative to direct climate impacts, is poised to magnify societal vulnerabilities and economic disruptions in multiple ways. The movement of populations from vulnerable zones to safer areas can:

- Strain urban infrastructure, housing markets, and public services in recipient locations, potentially exacerbating social inequalities and political tensions.

- Trigger labor market shifts that affect productivity, wage dynamics, and the spatial distribution of skills and industries.

- Create ripple effects in insurance and financial sectors as geographic risk profiles evolve, potentially destabilizing property markets and credit systems.

- Challenge governance frameworks created for static populations, requiring rapid adaptation of legal, social welfare, and human rights protections.

- Increase security risks as migration coincides with resource scarcity and geopolitical contestation over adaptation funding and territorial claims.

These consequences might play out unevenly across regions but also interconnect globally through supply chains, capital flows, and cross-border policy coordination needs (World Governments Summit, 2026). The fact that climate migration impacts industrial and governmental actors across sectors—from urban planners to insurers to human rights advocates—highlights its broad systemic relevance.

Implications

Organizations and governments should interpret climate-driven migration not merely as a humanitarian or environmental issue, but as a strategic risk and opportunity vector demanding integrated planning and innovation.

- Urban systems redesign: Cities expecting inbound migrants from climate-impacted areas need proactive investment in adaptable infrastructure focusing on equitable access to housing, transportation, and health services.

- Financial risk recalibration: Financial institutions should evolve risk modeling to incorporate dynamic, multi-scalar climate migration scenarios affecting asset valuations and credit risk.

- Labor and economic policy shifts: Policymakers must anticipate workforce redistribution patterns and adjust training, social protection, and employment programs accordingly.

- Legal and governance innovation: Governments will need frameworks to uphold rights of relocated populations, ensuring planned relocations and consent processes comply with international human rights standards.

- Cross-sector collaboration: Enhanced coordination among climate scientists, urban planners, social services, and defense sectors could create anticipatory strategies mitigating conflict and instability exacerbated by displacement.

- Early warning and resilience building: Investment in systems like Malawi’s CREWS initiative demonstrates the value of integrated early warning approaches to reduce forced displacement and protect vulnerable communities.

Ignoring the accelerating trend of climate-induced migration risks undermining sustainability and resilience efforts, while leveraging early insights may reveal new business models, governance innovations, and social cooperation pathways that foster adaptation and inclusive growth.

Questions

- How can urban planners design flexible infrastructure that anticipates population influxes linked to climate risks?

- What new financial instruments or insurance products could effectively price and distribute risks associated with climate migration?

- Which governance models best support equitable, voluntary climate relocation while preserving human rights and community cohesion?

- How might labor market programs evolve to integrate shifting demographic and skill distributions caused by climate mobility?

- What mechanisms can promote international collaboration to manage transboundary climate migration and associated security risks?

- How can early warning systems incorporate migration risk indicators to better inform emergency response and long-term adaptation?

Keywords

climate migration; sea-level rise; urban resilience; climate risk finance; human rights and climate; early warning systems; climate adaptation governance

Bibliography

- Sea-level rise does not stop at political borders, and so countries in the Global North - including Germany - are also increasingly threatened. Bosch Stiftung. https://www.bosch-stiftung.de/en/storys/sea-levels-rise-so-do-security-risks

- Miami, Florida, faces chronic sea-level rise that threatens low-lying neighborhoods, pushing residents inland to cities like Jacksonville and Atlanta. St. Augustine University. https://explore.st-aug.edu/exp/how-climatedriven-migration-is-reshaping-america-newsone-breaks-new-ground

- Urban extreme heat is an escalating climate risk across the Asia-Pacific region, driven by climate change, rapid urbanization, and existing social and economic vulnerabilities. United Nations Indico. https://indico.un.org/event/1022236/overview

- Rising temperatures due to climate change are a public health threat, endangering people's lives and livelihoods throughout the world. World Meteorological Organization. https://wmo.int/media/news/new-initiatives-launched-address-extreme-heat-south-asia

- Driven by the EU's strict ESG reporting directives, European insurers lead the world in integrating climate risk data into underwriting. Emerline. https://emerline.com/blog/insurtech-trends

- The Philippines is obligated under international human rights law to respect, protect, and fulfill everyone's economic, social, and cultural rights, and to protect them from reasonably foreseeable climate change risks, including sea-level rise and other climate change impacts. Human Rights Watch. https://www.hrw.org/news/2026/02/18/philippines-planned-climate-relocations-threaten-rights

- Malawi is emerging as a model for climate-vulnerable nations by uniting political leadership, communities, and international partners to strengthen early warning systems under the Climate Risk and Early Warning Systems (CREWS) initiative. CODATA. https://codata.org/disaster-risk-reduction-and-open-data-newsletter-february-2026-edition/

- Leaders and experts are exploring how governments can remain resilient and responsive as global challenges become increasingly complex and interconnected, from technological disruption to climate change and economic uncertainty. World Governments Summit. https://www.worldgovernmentssummit.org/media-hub/news/detail/world-governments-summit-world-leaders-gather-in-dubai-to-discuss-future-governance-strategies

- Earth could be entering a period of unprecedented climate change on a one-way trajectory, in which processes such as ice-sheet collapse can continue even if the average global temperature is stabilized. Coyote Gulch Blog. https://coyotegulch.blog/2026/02/16/

- Crossing certain thresholds could lock the planet into an irreversible trajectory, global temperatures are at their highest in 125,000 years, and climate change is progressing faster than expected. Anews. https://www.anews.com.tr/world/2026/02/18/global-warming-nears-point-of-no-return-hothouse-earth-warning